Moldmaking Activity Begins 2024 With Slowed Contraction

January index reading reflects February-March 2023 readings as it slinks toward a reading of 50. There are high hopes that it may continue on this path to sustained expansion for 2024.

#ecomonics

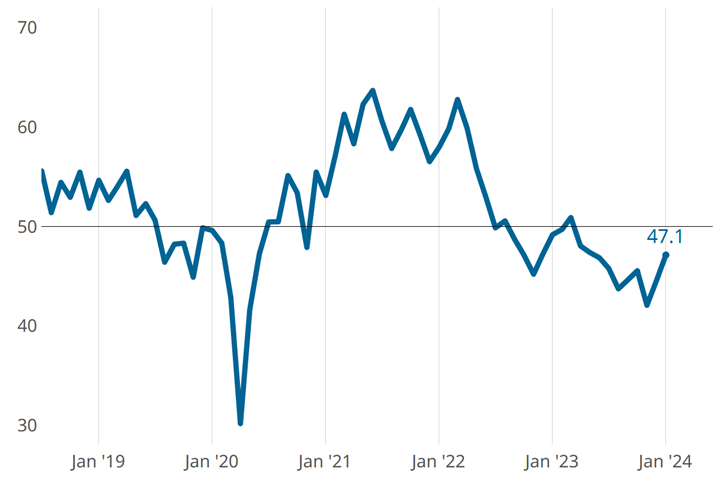

GBI: Moldmaking activity was up 2.6 points in January. Source, all images: Gardner Intelligence

Moldmaking activity slowed contraction in January for the second month in a row, with the Gardner Business Index (GBI) ending January at a reading of 47.1. This reading is up 2.6 points from December — the past two-month trend parallels about a year ago, when moldmaking activity inched its way to readings of 50 and higher (growth territory) beginning in March. Not to get ahead of ourselves, but 2024 seems to be off to an encouraging start.

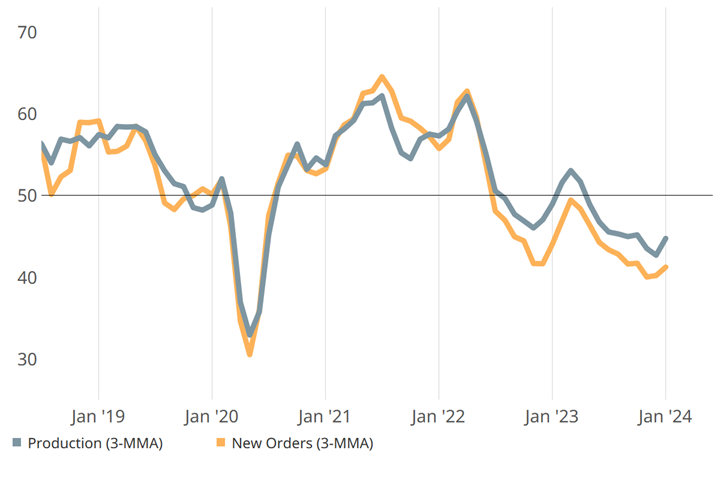

The combination of slowed contraction in new orders and production, combined with stable employment and backlog, drove the slowed contraction in the overall moldmaking index. Supplier deliveries returned to flat activity after contracting during the fourth quarter of 2023 while exports contracted faster in January.

Expectations of future business (not part of the GBI calculation) continue to be bullish and may, in part, reflect a leveling of the rate of material price increases along with the supply chain not being much of an issue.

New orders and production contributed to January’s slowed contraction. (This graph shows three-month moving averages.)

RELATED CONTENT

-

Moldmaking Industry Expansion Slows “‘All Around”’ in May

Moldmaking continues on the slowing expansion trend for the month of May according to Gardner Business Intelligence’s latest report on the Moldmaking Index.

-

Moldmaking Industry Continues Upswing in March

The Moldmaking Index has seen a rise of more than six points since the end of 2021, manifested primarily between the months of February and March as new orders, backlog and production continue to accelerate.

-

Moldmaking Index Continues Slowing Expansion Trend

The Gardner Business Index (GBI) and the majority of its components showed up in June at a slowing rate of expansion that has not been seen since early 2021.